Google Click Fraud Settlement A Raw Deal?

By: Andy Beal

By: Andy Beal

2006-04-27

I received an interesting press release from Los Angeles law firm Kabateck Brown Kellner LLP. They're clearly unhappy...

...with the recent $90 million settlement and I'm guessing would like to encourage others to think the same way.

Link: Kabateck Brown Kellner LLP

They obviously have their own motives, but I thought the release made some valid points, so here it is in full:FOR IMMEDIATE RELEASE April 26, 2006

GOOGLE'S $90 MILLION ARKANSAS CLICK FRAUD SETTLEMENT

LEAVES LITTLE FOR VICTIMS

LOS ANGELES, CALIF. -Brian Kabateck, an attorney representing plaintiffs in a Federal Court "click fraud" class action pending against Google in California, says the $90 million preliminary settlement in an Arkansas case announced April 20 includes a $30 million windfall for the plaintiffs' attorneys but provides only pennies in credits to Google click fraud victims. The most a victim can expect to receive is about a half a cent for every $1 lost to click fraud.

After reviewing the 46-page preliminary settlement, Kabateck, partner with Kabateck Brown Kellner LLP who represents Google's Adword customers in AIT v. Google, says the proposed settlement in Lane's Gifts and Collectibles LLC, et al., v. Yahoo! Inc., et al. is almost financially meaningless to Google, which reported $1.5 billion in profits for 2005, of which nearly all comes from advertising appearing on search engine results pages (click advertising). Click fraud typically occurs when an advertiser's competitor repeatedly clicks on the advertising. Google and other search engines charge advertisers for each click, regardless of whether the clicks are fraudulent or valid.

The key points in the settlement, according to Kabateck, are:

--Google is not required to change the way it does business. Google can continue to bill its customers for invalid or fraudulent clicks, and it is not required to improve or change its click fraud prevention efforts.

--Industry analysts believe a conservative 10-to-20 percent of all on line advertising is fraudulent. In the past four years, Google has earned over $15 billion in advertising income; thus, more than 1.5 billion is potentially at stake. The $90 million settlement represents less than 6 percent of the money Google has made from fraudulent advertising.

--Of the $90 million proposed settlement, the only cash component is $30 million set aside to pay for attorneys' fees.

--The remaining portion of the $60 million settlement will be in credits to future Google advertisers, but provides nothing to the tens of thousands of customers who no longer are Google advertisers. Customers no longer doing business with Google get nothing.

--Google will never actually pay $60 million to its customers. The $60 million in credits is based on the assumption that all click advertising is fraudulent. If the actual rate of invalid or fraudulent clicks is between 10-to-20 percent, the most credits Google will be required to give to its advertisers will be between $6 million and $12 million.

--The sole determination of whether a click is invalid or fraudulent will be made by Google. Thus, the pool of credits can be substantially reduced by Google at its sole discretion.

--Even in the best-case scenario, customers will never receive a full refund credit for fraudulent advertising. According to the settlement terms, customers will only be refunded about one half a percent (0.5 percent). For example, if Google determines the customer was charged $10,000 for fraudulent advertising, the customer will only receive $50 in credit when it next advertises with Google.

--Advertisers will have to affirmatively apply for the credits. Because the credit refunds are so insignificant, it is unlikely most advertisers will make applications for the credits.

--Under Google's current customer agreements, anyone with grievances with Google can receive up to a 100 percent refund. If this settlement were approved, it would supercede current agreements and reduce the refund by 99.5 percent.

Google's corporate philosophy includes the line, "You can make money without doing evil." "Amazingly," says Kabateck, "Google apparently doesn't see cheating its customers out of billions of dollars as doing evil."

Class members have 30 days after Google e-mails them a notice of the settlement (on or before May 20, 2006) to opt out of the settlement agreement. "If Google customers do not opt out, they will be forced to abide by the settlement," says Kabateck. To opt out, customers must submit a written and signed statement requesting exclusion from the class. This statement must also identifying their name, or if a company is opting out, state the company's name and specify that the author is authorized to act on the company's behalf.

Final approval of the settlement will be decided in July. Kabateck says he plans to file appeals challenging the settlement in federal court and in state court in Arkansas. DiggThis

Technorati: google

View All Articles by Andy Beal

About

the Author:

Andy Beal is an internet marketing consultant and considered one of the world's most respected and interactive search engine marketing experts. Andy has worked with many Fortune 1000 companies such as Motorola, CitiFinancial, Lowes, Alaska Air, DeWALT, NBC and Experian.

You can read his internet marketing blog at Marketing Pilgrim and reach him at [email protected].

|

|

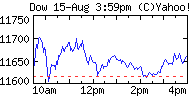

| Dow |

13566.97 |

44.95 |

(0.33%) |

| Nasdaq |

2753.93 |

0.00 |

(0.00%) |

| S&P 500 |

1506.33 |

0.00 |

(0.00%) |

|

FREE

IFN

Newsletter

FREE

IFN

Newsletter

By: Andy Beal

By: Andy Beal